Insurance Update Guidelines

If Pt will change the bill from Self Pay to INS or you see an IMMEDIATE/SELF PAY to INS please refer to these articles

Self-Pay to Billing Insurance

Immediate or Unkown to Insurance

If the INS is calling to add the INS , you can take the information.

If the patient is calling and the INS is on the line, you can take the information.

If patients want to switch from Self-Pay to billing their TRICARE insurance, the call should be warm transferred to PTE.

If patients want to switch from Self-Pay to billing their PROGYNY insurance for Spectrum or Horizon, please warm transfer to Spectrum 650.412.7251

Please note that ANORA can’t be billed through PROGYNY

Not Accepted as insurance: Workers’ compensation insurance companies

Workers’ compensation insurance, sometimes referred to as workers comp coverage, is a form of business insurance that pays out the cost of medical care and part of the lost income of employees who get sick or injured while performing their jobs

Some examples include:

- Travelers

- The Hartford

- AmTrust Financial

- Zurich Insurance

- Chubb

- Liberty Mutual

- Berkshire Hathaway

- New York State Insurance Fund

- Old Republic

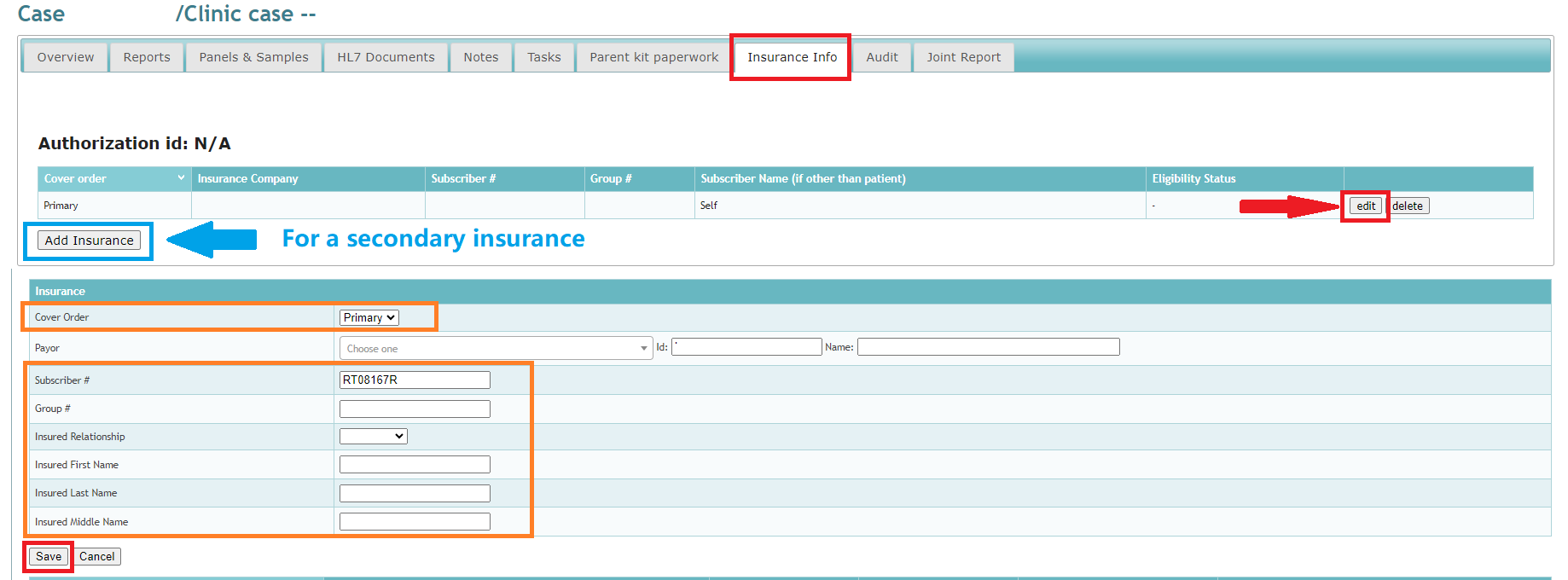

| PROCESS | WHEN TO USE IT? | WHAT TO DO? |

| INSURANCE UPDATE CASES NOT IN AMD | If the case does not load in AMD or shows as ‘Closed to insurance’ in Natera Care, and you can’t find it on AMD or Natera Care, follow this Pro Tip: Always search for linked cases in LIMS and attempt to load the information on AMD. Remember to read previous notes consistently. | • Ask for the patient’s insurance information (Name of the Insurance Plan, Effective Dates, Member ID, Group # if available, Medical Claims Address)

Add insurance information in LIMS• There’s no need to send an Insurance Update ticket as the case is not in AMD • Leave notes in LIMS • ADVISE PATIENT OF THE TURN AROUND TIME: 30-45 business days |

| INSURANCE UPDATE ADDING A NEW PLAN (Secondary Insurance) | Use this one when the patient is adding secondary insurance or adding Medicaid | Please collect as much information as possible so that the patient’s insurance will accept the claim request.

Insurance information you must askfor you to submit the claim: Case Number: Effective Date: For Progyny as a secondary ask the following: Effective Date Add insurance information in LIMSLeave notes in AMD and LIMS Submit an “Insurance Update” ticket via Syncro CRM. ADVISE PATIENT OF THE TURN AROUND TIME: 30-45 business days |

| BLUE CROSS BLUE SHIELD PLAN | Use this one the first time you are adding a BCBS insurance on the patient’s account or if you are adding BCBS as secondary | Follow the same steps for a regular insurance update, but before entering the Carrier name (plan’s name), please go to:

• Custom Tab in AMD |

| INSURANCE UPDATE MODIFYING AN EXISTING ENTRY | Use this one when the plan is already in the system but details such as the coverage, member ID, and/or group# need to be modified | • Ask you patient all relevant details such as the name of their plan, member ID, group number and medical claims address (usually on the back of the card)

Add insurance information in LIMS• Remember that if the patient has 2 commercial plans, you must ask which coverage has which. • If the patient has a commercial + a Medicaid plan, Medicaid is ALWAYS secondary. • Leave notes in LIMS and AMD • ADVISE PATIENT OF THE TURN AROUND TIME: 30-45 business days |

| INSURANCE UPDATE NO RESPONSE YET | Use this one ONLY when an insurance update was sent properly but after 45 BD it doesn’t have an answer or if 2 or MORE weeks have gone by with no updates or claim sent after the insurance update ticket was submitted | • Submit a Synergen Escalation

Add insurance information in LIMS• ADVISE PATIENT OF THE TURN AROUND TIME: 30-45 business days • Leave notes in LIMS and AMD |

If you can’t find the exact payor name, you must still fill all of the other fields.

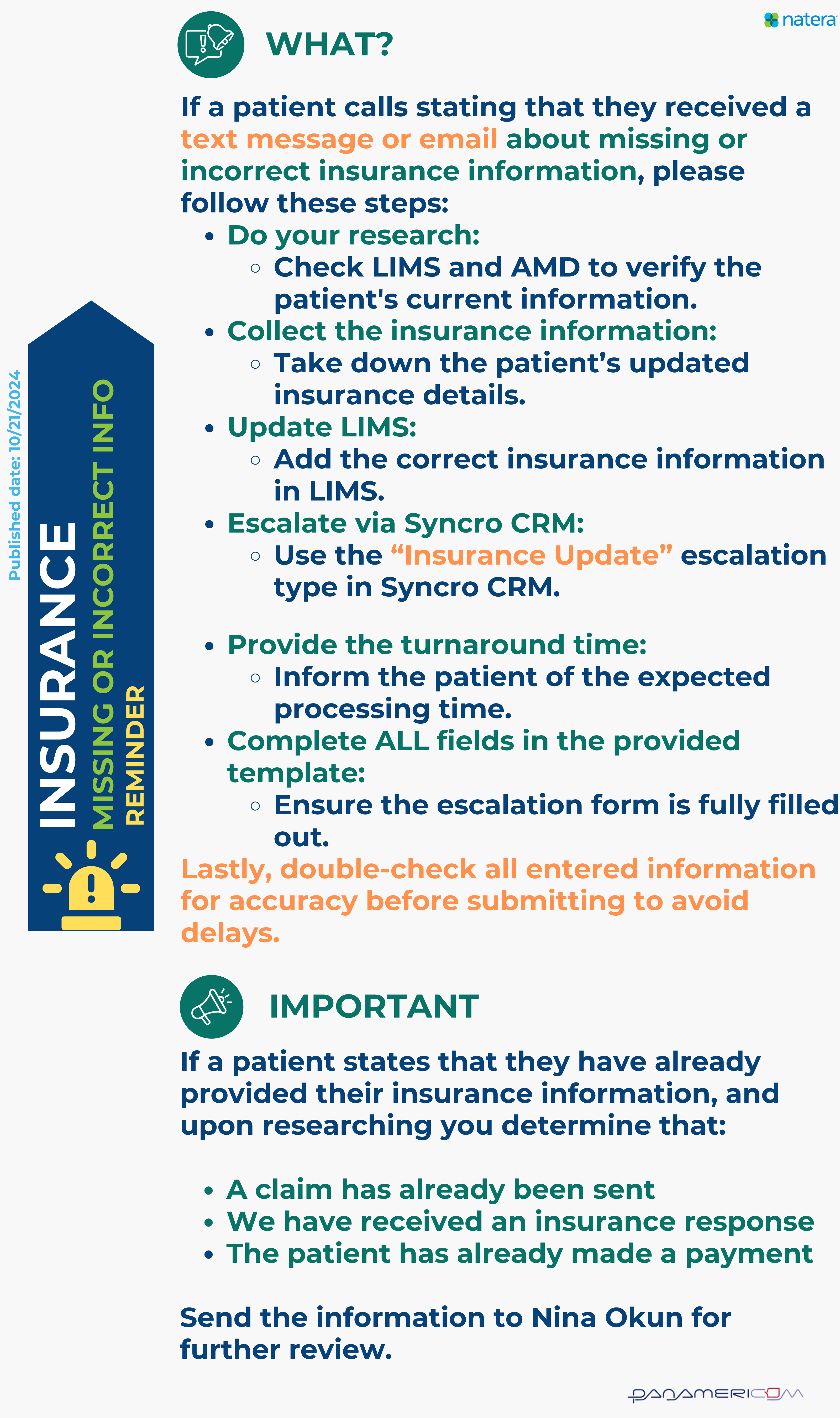

Notification About Missing Insurance Information Requests

What you CAN and CAN NOT do when an insurance agent calls:

DO’s

- Provide the claim address and/or fax number when requested.

- Assist with calls regarding medical records.

- Discuss prior authorizations when applicable.

- Advise the patient of a billing hold while their claim is being processed.

- Request an Explanation of Benefits (EOB) if a refund is being requested and send it to: [email protected].

DONT’s

- Do not disclose the amount we are billing the patient or subscriber.

- Do not discuss billing when the Explanation of Benefits (EOB) shows $0.

- Do not discuss balances

- Do not advise of any billing options

- Avoid discussing the patient’s balance at all.

TIMELY CLAIM SUBMISSION

A regular claim is to be sent within the first 180 calendar days after the Date of Service; however, insurance agents may call in stating there’s a specific time for the claim to be sent (usually less than the regular timeframe)

It’s probable but not likely that patients are calling for this reason but it’s still possible for you to assist them as long as they have the details we need.

TAT FOR CLAIM SUBMISSION:

- CIGNA 90 Days

- BCBS 1 Year

- AETNA 180 Days

- HUMANA 1 Year

- MEDICAID Has no time frame; it can be submitted at any time

- Most of the other insurances have 180 days

Submit an Insurance Update

Timely Claim Submission: Request the information below from the insurance agent.

- Ask the agent for the limit date we have to submit the claim

- Ask agents for the Call Reference ID

- Enter agent’s first name and last name initial (or caller’s name)

- Ask for their best contact number

It will take 3 business days for Natera to process the details and send the claim.

Related topics:

Immediate and Unknown to Insurance

Last update by: Claudia F (April 25, 2025)