OON Bills

All the essentials

Handling Calls About OON Insurance Plans and EOBs

When a patient with an Out-of-Network (OON) insurance plan calls after receiving an Explanation of Benefits (EOB) showing a lower Patient Responsibility (PR), please follow these steps to guide the conversation:

1. Clarify the EOB Details

Patients may misunderstand their EOB, so assist them in reviewing it:

- Locate the payment information: Ask the patient to read how much the insurance has paid to Natera.

- Find the Patient Responsibility column: Guide them to locate the amount they are responsible for.

- Check for denials: Look for any denials listed on subsequent pages of the EOB.

2. Explain the Actual Balance

Once they’ve identified the key details on their EOB:

- Inform them that the insurance hasn’t paid anything to Natera and the PR listed is the Full List Price (Natera’s investment cost), typically between $3,900 and $15,000.

3. OON Payment Adjustment Policy

For OON cases, explain the balance adjustment:

- If PR1 , PR2 or PR3 is greater than $749, the balance is adjusted down to $749 (the maximum out of pocket cost).

- If PR1 , PR2 or PR3 is lower than $749, the patient is charged only the amount stated in the EOB without increasing it to $749.

You can say:

“Based on your insurance’s explanation, your responsibility was higher than $749. We applied a discount to make testing more affordable because we are out of network with your insurance. Are you able to make this payment today?”

4. Clarify Insurance’s Role

Explain that insurance companies do not track what patients pay on medical bills. Once the insurance provides the EOB stating the patient’s responsibility, it becomes a matter between the patient and the provider.

5. Collect the Remaining Balance

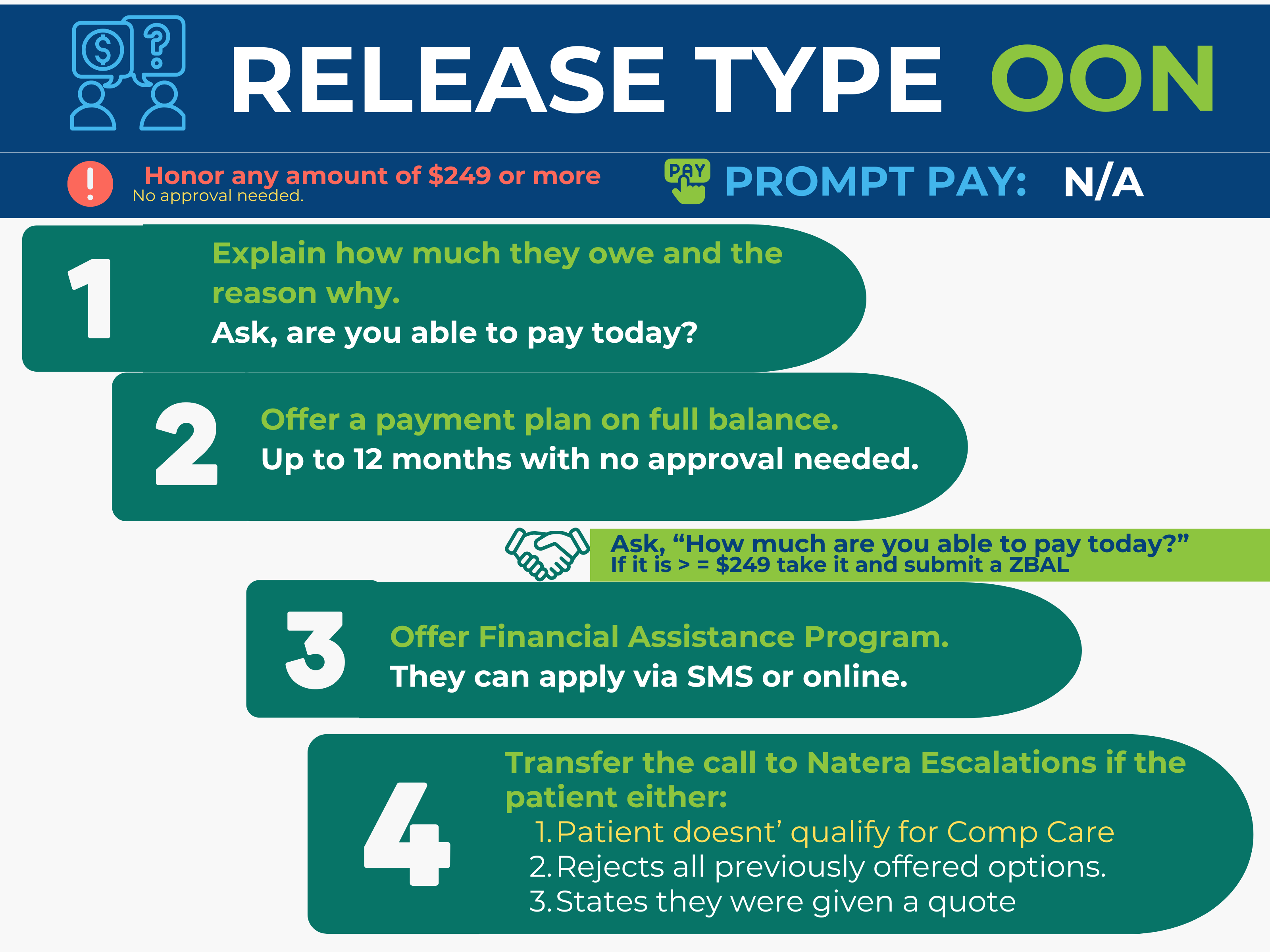

Follow the walkdown to address their concerns and explore payment options.

Related Topics:

Walkdown 2024

Last update by: Nina O(Nov 15, 2024)