REFUNDS

When patients request a refund, certain requirements must be met to proceed with their request:

- Ensure the payment is recorded in AMD’s history.

- Determine the reason for the refund request:

- If the patient overpaid the original bill amount, a Refund request is appropriate.

- If the patient paid the full bill amount and later claims they were quoted a special price, explain that special prices must be honored at the time of payment, and a refund cannot be processed.

- If the patient paid the full bill amount and later states they were approved for Compassionate Care, explain that Compassionate Care rates should have been applied before payment, and a refund cannot be processed.

Submit an escalation via Syncro CRM using the “Refund” escalation type and document notes on the account.

We do not guarantee the outcome of the refund request or specify how refunds will be processed (check or card). Inform patients that turnaround times can vary, with processing taking up to 30 business days depending on the payment method.

REFUND REQUEST SENT MORE THAN 30 DAYS AGO

If the standard refund processing time is insufficient, follow these steps:

- Check AMD’s history for any recorded credits and review AMD notes for potential answers or details, including Sales Force/JIRA Ticket entries.

- If there is a ticket, request updates from your CSS regarding its status.

- In rare cases where the refund process exceeds the standard turnaround time or no JIRA ticket is found in AMD notes after 60 days, submit an Executive Escalations via Syncro CRM. Include the patient’s case number, pertinent details, and a brief explanation of the situation.

This escalation typically yields an internal response within 3-5 business days, allowing us to clarify why the refund has not been completed.

Please refrain from guaranteeing any specific outcomes to patients; instead, advise them to follow up for updates.

IMMEDIATE REFUND

Please remember that this escalation form will ONLY be applicable for the following scenarios:

- The patient paid the incorrect amount by mistake.

- Synergen Pay made an extra charge on a payment plan.

- A refund was requested and the ticket never was created.

- The agent collected the incorrect amount.

Please ensure you meet the following requirements before submitting the escalation through your CSS. The turnaround time for an update is also 3-5 business days.

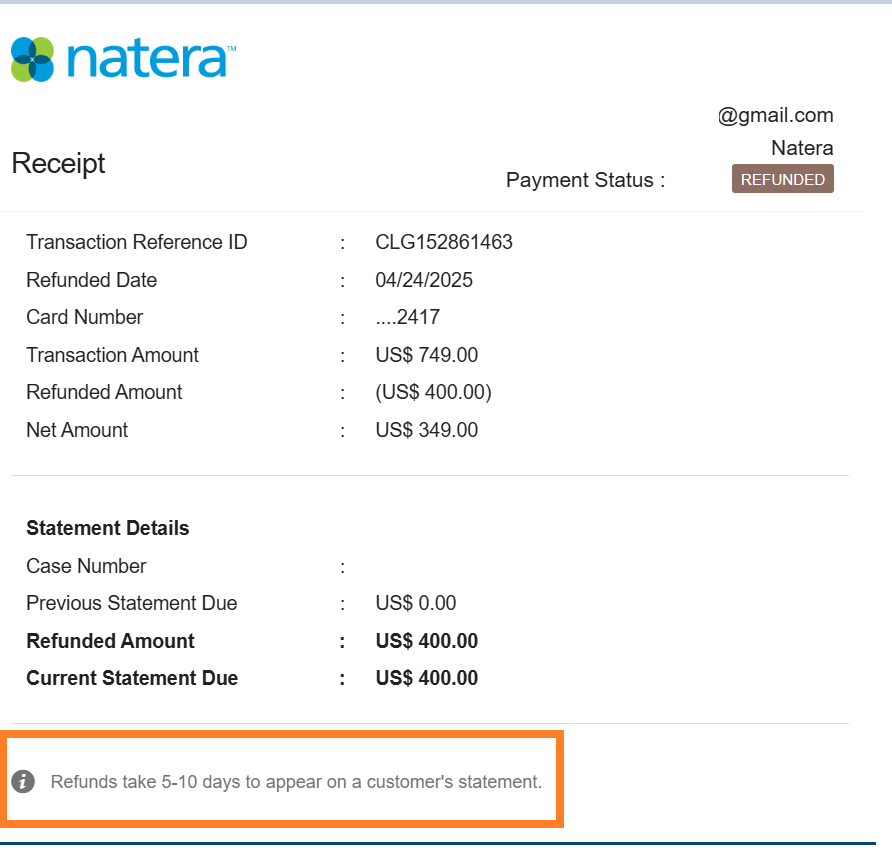

REFUND STATUS

Make sure you are always looking at the notes or Synergen Pay to view all the refund details.

Note that if it was via ACH it may take up to 10 days to be reflected

INSURANCE REFUND

Please be aware that in some scenarios, insurance companies may overpay Natera and they will contact the Call Center to process a Refund request.

Please capture all necessary details according to the send the regular escalation form in Syncro CRM. Turnaround time depends on the method of payment, it can take up to 60 business days.

HSA/FSA/HRA REFUND

Please follow the steps below if you find out that the insurance payment came from a patient’s HRA/HSA/FSA and want this to be refunded back to the patient’s HRA/HSA/FSA.

Steps to be done:

- We need a copy of the EOB the patient has– ALL pages

This shows proof that it did come out of their HRA/HSA/FSA - Send an email to [email protected] with a copy of ALL pages of the patient’s EOB

- Courtesy Exception approval needs to be on the email stating they approve for us to refund HRA/HSA/FSA

- The email needs to state how much we will charge the patient after we send the money back to the insurance

HRA/HSA/FSA refunds can take some time to return

HSA:

A health savings account (HSA) is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan (HDHP).

FSA:

A Flexible Spending Account (also known as a flexible spending arrangement) is a special account you put money into that you use to pay for certain out-of-pocket health care costs. You don’t pay taxes on this money. This means you’ll save an amount equal to the taxes you would have paid on the money you set aside.

HRA:

An HRA, or Health Reimbursement Arrangement, is a kind of health spending account provided and owned by an employer. The money in it pays for qualified expenses, like medical, pharmacy, dental, and vision, as determined by the employer. Other key thing to know about HRAs is: Only your employer can put money in an HRA.

RETRACT-STOP CLAIMS

Patients may call to request a stop/retract claim.

These reasons outline the scenarios where escalation is necessary, ensuring clear understanding and correct handling of each situation. Ensure you submit the Syncro CRM escalation ONLY if it is related to one of the following reasons.

- Natera Employee:

- The patient is a Natera Employee, and the claim was sent to insurance.

- Redraw Issue:

- A redraw was performed but not correctly linked, resulting in billing for the redraw even though the original test had already been billed.

- Exception: Redraw must be for the same test (e.g., H4 to H4). If the patient changes tests (e.g., H4 to H274), both cases should be billed.

- Patient’s Financial Account Use:

- The patient’s FSA/HRA/HSA funds were used. Therefore, a refund is necessary, then converting the case into a self-pay scenario.

- If the insurance company made their payment using a FSA or HSA account, besides the EOB, we need to have the FSA/HSA account information to submit the request. These details will be provided to the patient by their bank or insurance company.

- Only after the account details are available you can send a Refund escalation -STOP CLAIM—through Syncro CRM. Synergen will try to cancel the claim, and if it goes through successfully, the refund request will continue.

- Billing Error:

- We billed the insurance when the clinic was supposed to be billed.

- Progyny Issue:

- The patient has Progyny coverage – for Spectrum & Horizon only – , but we billed the insurance instead.

- Duplicate Charge:

- The patient paid out-of-pocket (PTP), and it was sent to the insurance as well.

- IVF:

- The IVF patient opted to pay out-of-pocket and avoid using their insurance to preserve their IVF benefits.

For any other scenarios, DO NOT submit an escalation and follow the walk-down.

Ineligible Claim Retraction Cases

- NCS: All NCS cases are ineligible for a claim retraction

- OA-100: All OA-100 cases are ineligible for a claim retraction.

- Exception: However if a patient states they received a correspondence from their insurance provider stipulating a retraction of the claim, then the rep must advise the patient to send a copy of the letter to [email protected] for review and resolution.

- Once the copy of the letter is received, reps working on the [email protected] queue will forward it to the “Insurance Overpayment queue via [email protected] in Salesforce so this team can process the claim retraction request.

INSURANCE TO SELF-PAY

If a patient wants to switch to Self-Pay as the billing method instead of insurance and the case is already closed to insurance in Natera Care, advise the patient that the claim was already sent to insurance and needs to wait for EOB, once the bill has been printed; agents can apply the walk-down.

We should never stop a claim because the patient wants to apply for Compassionate Care.

Last update by: Claudia F (Feb 20, 2025)